Seamless pipe prices drifted lower this week, with the national average dipping 11 RMB/ton to 4,403 RMB/ton as downstream demand underperformed. While U.S. jobless claims rose to 223,000 and the Fed held rates steady, domestic policy inertia persisted with unchanged LPR rates. Mills continued transferring inventories to traders, pushing social stocks down 0.46 million tons to 713,100 tons, though demand recovery remains fragmented.

Regional Price Movements

Eastern China Leads Declines:

Shanghai: 4,370 RMB/ton (-50 WoW)

Nanjing: 4,240 RMB/ton (-20 WoW)

Hangzhou: 4,360 RMB/ton (-40 WoW)

Raw Material Weakness

Shandong billets: 3,600 RMB/ton (-10 WoW)

Jiangsu billets: 4,090 RMB/ton (-30 WoW)

Regional spread narrows to 490 RMB (from 510 RMB)

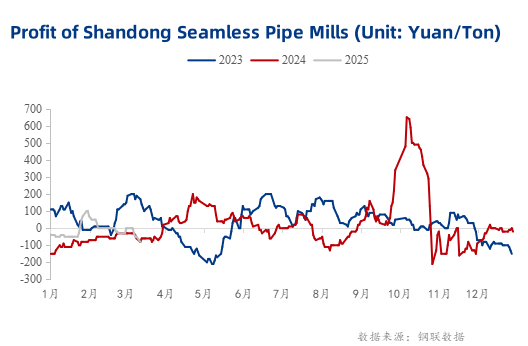

Mill Margin Squeeze

Shandong mills: -70 RMB/ton (+10 WoW improvement)

Jiangsu mills maintain 190-210 RMB/ton via export channels

Industry profitability index at 45 (100=breakeven)

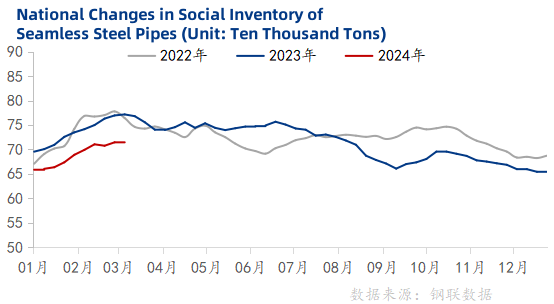

Stockpile Migration

Mill inventories: 614,900 tons (-0.4% WoW, -3.1% MoM)

Social inventories: 713,100 tons (-0.6% WoW)

Critical threshold: Social stocks need to break below 700K tons for bullish signal

Capacity Expansion

Weekly output reaches 353,900 tons (+2.3% WoW)

Operating rates hit 76.9% (+1.72pp WoW)

6 mills resume production, adding 85,000 tons/month capacity

Domestic Challenges

Infrastructure demand grows at 2.8% WoW pace, below seasonal norms

Export orders show Q2 contraction signals (-8% MoM forward bookings)

Trader inventories held at 18-22 day coverage (vs 25-day historical average)

Global Policy Impacts

Fed's 50bps 2025 rate cut projection pressures commodity currencies

China's LPR stability signals cautious monetary approach

ASEAN anti-dumping probes target 12% of China's pipe exports

Price Projections

Immediate Range: 4,380-4,420 RMB/ton consolidation

Upside Catalysts:

Social inventories falling below 700K tons

Shandong billet prices holding above 3,580 RMB

Downside Risks:

Export cancellations exceeding 15% of Q2 orders

Jiangsu billet prices breaking 4,000 RMB support

Operational Recommendations

Mills:

Cap production at 85% capacity utilization

Prioritize API-grade pipe exports (current premium: $120/ton)

Traders:

Maintain 20-day inventory with 30% futures hedging

Exploit regional price gaps (Nanjing-Shanghai spread: 130 RMB)

Buyers:

Delay bulk purchases until 4,380-4,400 RMB range

Secure quarterly contracts with floating price clauses