Price Stability: National average holds at 4,430 RMB/ton (-3 RMB WoW)

Critical Catalysts:

74.08% capacity utilization (+1.05pp WoW)

US imposes 10% tariff on Chinese goods (Mar 3生效)

ECB cuts rates by 25bps to 3.75%

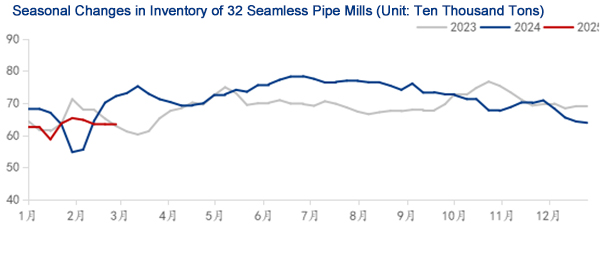

Market Alert: Mill inventories drop to 630,800 tons (-0.5% WoW) as circulation improves

Eastern China:

Shanghai: 4,420 RMB (-30 WoW)

Nanjing: 4,280 RMB (-50 WoW)

Hangzhou: 4,380 RMB (-20 WoW)

Raw Material Pressures:

Shandong billet: 3,520 RMB (-20 WoW)

Jiangsu billet: 4,110 RMB (-40 WoW)

Regional spread narrows to 590 RMB

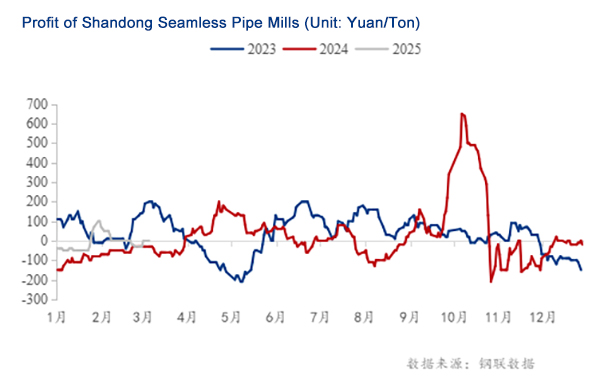

Shandong Mills:

Margins rebound to 0 RMB/ton (+30 WoW)

Benefit from delayed cost pass-through

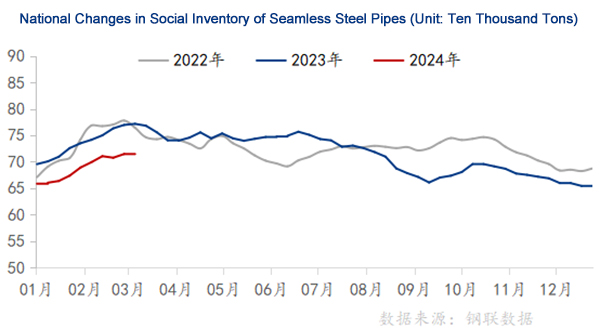

Social Inventory: 716,500 tons (+0.27% WoW)

Southern China: +1.2% (Rain-delayed projects)

Eastern China: -0.8% (Targeted destocking)

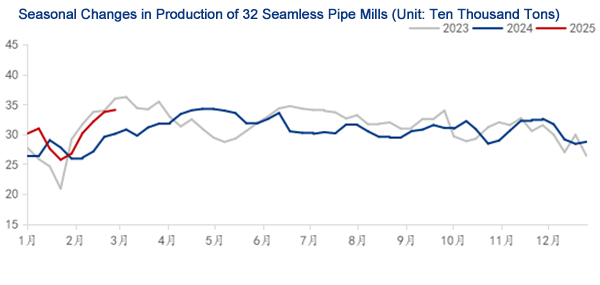

Production Insights:

Weekly output reaches 340,900 tons (+1.0% WoW)

Operating rate dips to 46.72% (-4.92pp WoW)

Trade Risks: US tariff escalation impacts 18% of export-oriented mills

Monetary Support: PBOC's 777.9B RMB liquidity injection pending

Transaction Volume:

65% traders report "moderate" demand recovery

Infrastructure projects resume at 70% pace vs 2024

Weather Disruptions:

Southern rainfall reduces 15% construction activity

Currency Pressures:

USDCNY hits 7.12 (+0.8% WoW)

Eurozone rate cut spurs capital outflows

Base Case (60%): 4,400-4,450 RMB range consolidation

Upside Risk (30%): Break above 4,480 on policy stimulus

Downside Risk (10%): Test 4,380 support on tariff escalation

Inventory Strategy:

Maintain 35-45 day coverage of high-turnover specs

Accelerate specialty grade rotations (API/EN certified)

Pricing Tactics:

Implement tiered pricing for volume buyers (5%+ discounts)

Hedge 25% exposure via CNY/USD futures

Policy Positioning:

Monitor Two Sessions steel VAT adjustments (Finalized Mar 10)

Prepare anti-dumping documentation for US-bound shipments