Overview

Steel and pipe billet prices declined this week amid slowing transactions, as rainy weather in southern China disrupted construction activity. Shandong mills faced shrinking profits and rising inventories, signaling tightening supply-demand dynamics. By May 23, the national average seamless pipe price fell RMB 4/ton, reflecting growing market pressures.

Seamless Pipes: The national average price for 108*4.5mm pipes dropped to RMB 4,337/ton (-4/ton WoW), with most markets trending weakly.

Raw Materials:

Shandong Billets: Fell RMB 30/ton WoW.

Jiangsu Billets: Declined RMB 10/ton WoW.

Mill Adjustments: 34 surveyed mills cut prices by RMB 30–50/ton.

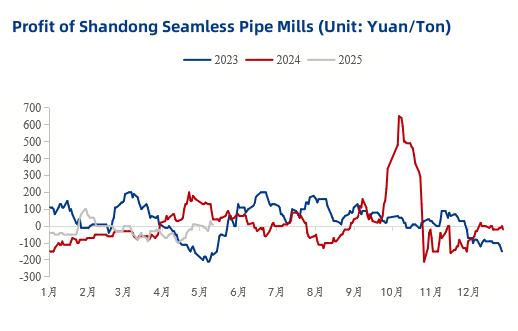

Shandong Mills: Losses widened to -RMB 40/ton (-50/ton WoW).

Jiangsu Mills: Profits shrank to RMB 70/ton (-30/ton WoW).

Price Movements: Shanghai, Nanjing, and Hangzhou prices held flat WoW.

Demand: Sluggish post-holiday transactions persisted, with traders prioritizing inventory clearance.

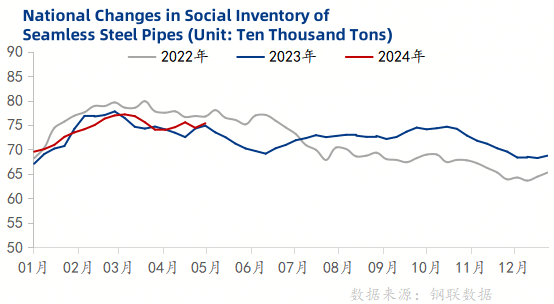

Inventory: Social stocks rose 10,600 tons WoW to 709,000 tons, reversing prior declines.

Social Stocks: Increased 9,400 tons WoW to 709,000 tons.

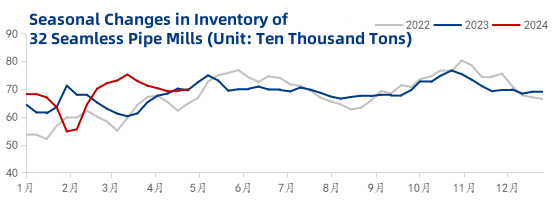

Mill Stocks: Rose 4,300 tons WoW to 630,700 tons (+25,800 tons MoM).

Raw Material Stocks: Fell 4,400 tons WoW to 291,700 tons (-5,000 tons MoM).

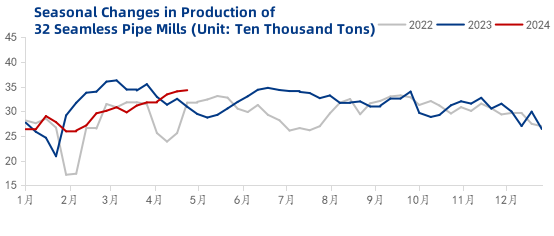

Production: Output dipped to 364,600 tons (-4,900 tons WoW, +1,600 tons MoM).

Capacity Utilization: 79.23% (-1.06% WoW, +0.35% MoM).

Operating Rates: Held steady at 54.1% (-0.82% MoM).

Price Drivers: Weak futures and falling billet costs erode price support.

Fundamentals: Rising inventories and forced mill maintenance signal "weak supply, weaker demand."

Sentiment: Prolonged southern rains dampen hopes for demand recovery, keeping traders cautious.

Conclusion: Seamless pipe prices are expected to trend weakly next week, pressured by seasonal demand slumps and inventory buildup.