Overview:In December, the market entered its traditional off-peak season, and seamless pipe prices continued a slight downward trend. Fundamentally, December saw a shift in seamless pipe supply from increasing to decreasing, while demand continued to slide, resulting in transaction performance falling short of expectations. Production enterprise profits shrank, indicating poor profitability for mills. Overall, December presented a pattern of "weak supply and weak demand," with a generally weak price trajectory. Looking ahead to January 2026, this report summarizes the December fundamentals and forecasts price trends for the coming month.

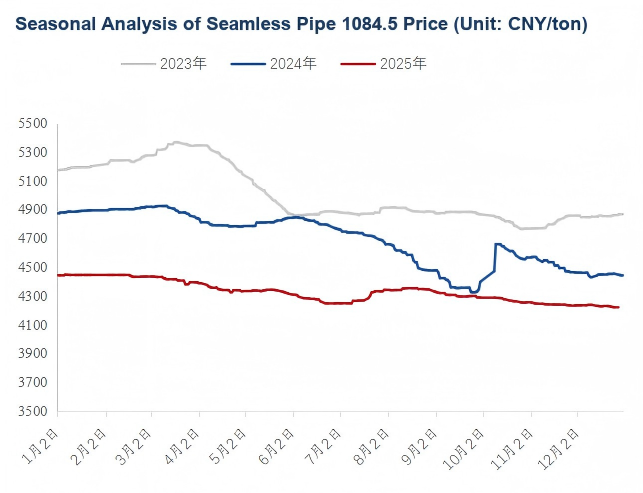

Prices Softened Slightly in December:According to Mysteel statistics, as of December 31, the average price of domestic seamless pipes (20#, 108*4.5mm) was 4,215 yuan/ton, a decrease of 16 yuan/ton (-0.38%) compared to the end of November. As the off-season deepened, trading volume dropped, prompting merchants to adopt a "price for volume" strategy.

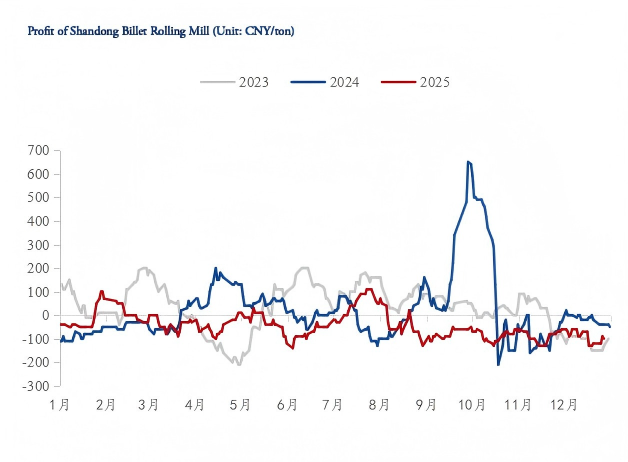

Mill Profits Remained Poor:As of December 31, the average profit for sample seamless pipe mills in Shandong (based on 20# hot-rolled, Ф108*4.5mm) was -100 yuan/ton, shrinking by another 20 yuan/ton month-on-month. With the market in a "double weak" state (supply and demand), some mills voluntarily cut production, alleviating some supply pressure. However, low trader restocking enthusiasm and high costs meant mill profitability did not improve. Despite promotional policies and subsidies, operational pressure remains high.

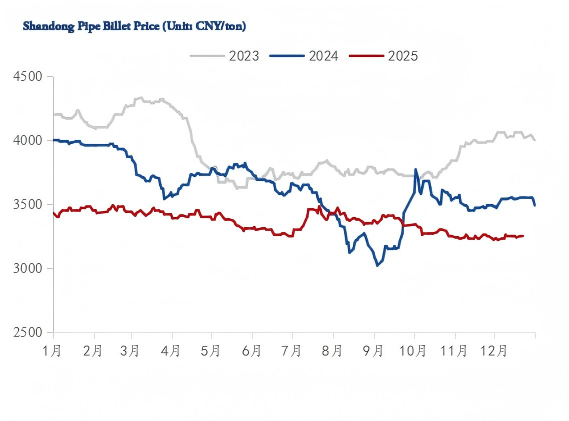

Raw Materials:On December 31, Shandong tube billet prices were reported at 3,250 yuan/ton, up 20 yuan/ton (+0.62%) month-on-month. Prices strengthened slightly after fluctuations due to concentrated steel mill maintenance and frequent environmental production limits in the North.

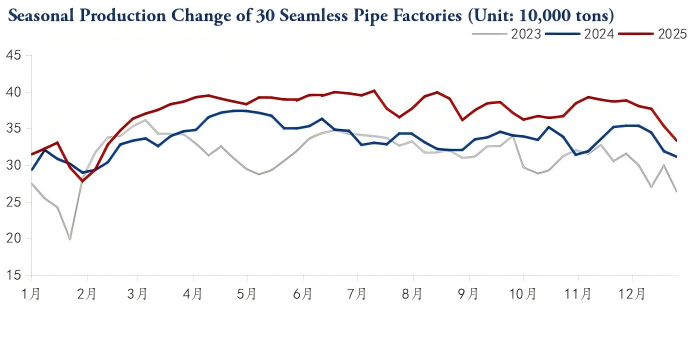

Significant Decline in Supply:Many production enterprises conducted routine maintenance in December, causing output to drop significantly. Mysteel's survey (32 enterprises, 110 lines) showed output in the last week of December at 333,300 tons (down 53,100 tons month-on-month). Capacity utilization dropped to 66.84% (down 10.65% month-on-month). With more mills expected to enter maintenance before the Spring Festival, low production levels are likely to persist.

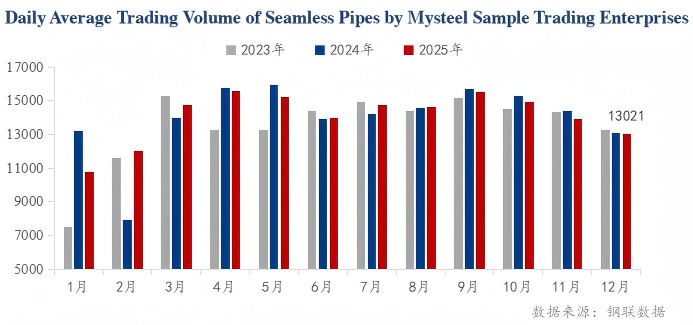

Transactions Hit Off-Season Levels:Data from Mysteel's survey of 123 trading enterprises showed an average daily trading volume of 13,021 tons in December, a decrease of 1,900 tons (-12.73%) from November. This seasonal decline aligns with traditional off-peak characteristics. Regionally, the decline in the North was significantly larger than in the South.

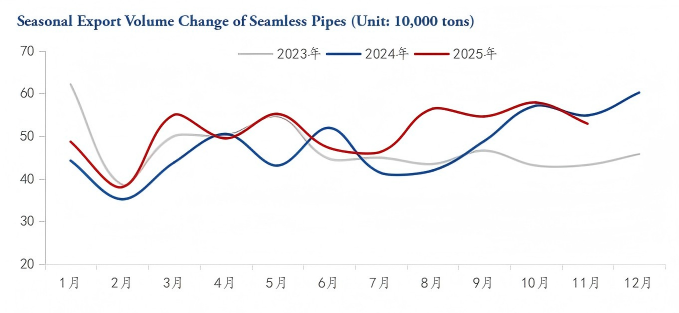

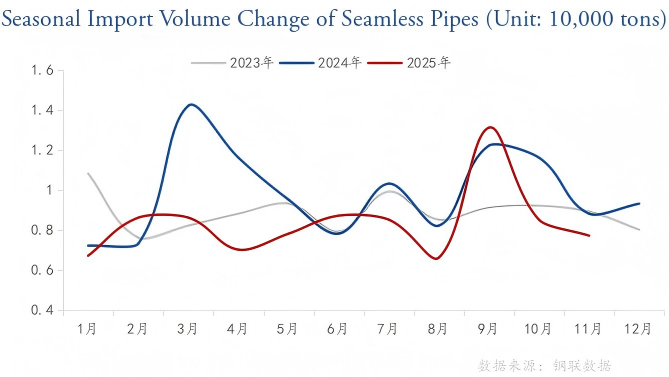

Volume: In November, China exported 528,500 tons of seamless pipes (down 8.58% MoM, down 3.54% YoY). Cumulative exports for Jan-Nov 2025 were 5.61 million tons, up 9.55% YoY. Imports also fell.

Price: Export prices rose in November due to raw material cost increases. The average export price was $8,655.90 yuan/ton (up 10.64% MoM).

December was characterized by falling prices and profits, significantly reduced supply and inventory, and declining demand despite resilient exports.

Outlook for January:

Macro: The market is in a policy vacuum period with no major positive news expected shortly.

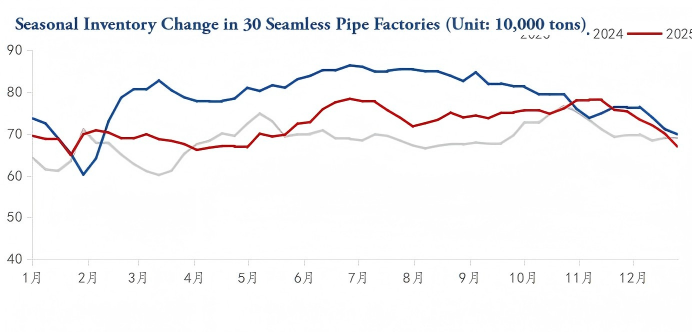

Supply: Maintenance and production halts will likely concentrate in Jan-Feb, causing supply to drop further. Mill inventory pressure is low.

Demand: Transactions will weaken further. "Winter storage" (restocking for spring) enthusiasm is low this year; merchants are restocking sparingly.

Inventory: As winter storage resources arrive, social inventory may shift from decreasing to passive accumulation.

Conclusion: With the macro policy vacuum, rapid declines in both supply and demand, and the onset of an inventory accumulation cycle, seamless pipe prices are expected to undergo a slight weak adjustment in January.