Overview

Steel futures fluctuated this week amid muted trading activity and cautious sentiment. Key data for the five major steel products:

Supply: 8.7584 million tons (+0.4% WoW).

Total Inventory: 15.3427 million tons (-3.2% WoW).

Consumption: 9.2625 million tons, with construction materials down 6.9% WoW and flat products down 0.7% WoW.

Seamless pipe prices edged down RMB 1/ton despite mixed regional price movements.

Seamless Pipes: National average price for 108*4.5mm pipes dipped to RMB 4,338/ton (-1/ton WoW), with regional volatility.

Raw Materials:

Shandong pipe billets rose RMB 20/ton WoW.

Jiangsu pipe billets gained RMB 10/ton WoW, narrowing the regional gap.

Mill Adjustments: 34 surveyed mills raised prices by RMB 20–50/ton, while some cut by RMB 50/ton.

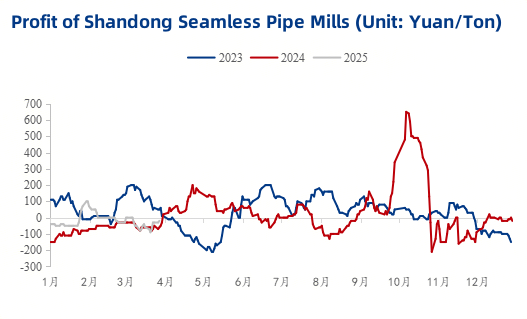

Shandong Mills: Losses narrowed to -RMB 20/ton (+60/ton WoW).

Jiangsu Mills: Profits held at RMB 180/ton (flat WoW)

Shandong pipe billet prices fluctuated (+10–30/ton WoW), with mills offering modest discounts. Regional prices were mixed, though inventories declined slightly.

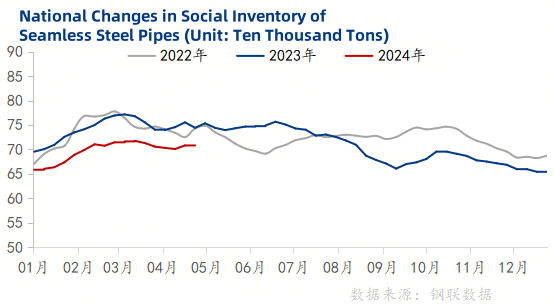

Social Stocks: Inched up to 708,400 tons (+200 tons WoW).

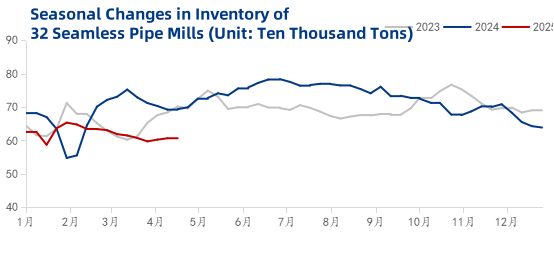

Mill Stocks: Fell to 604,900 tons (-1,700 tons WoW).

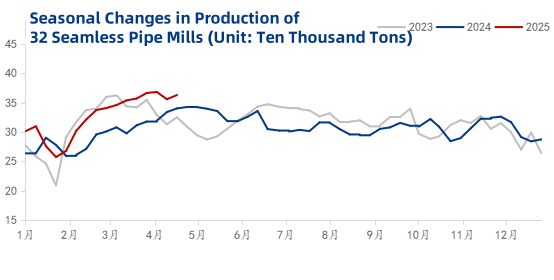

Production: Output rose to 363,000 tons (+7,100 tons WoW), with capacity utilization at 78.88%.

Pre-holiday cost support and stable demand may limit volatility.

Supply: High output persists, but inventories remain manageable.

Demand: Daily consumption steady at 15,000 tons, with pre-holiday restocking anticipated.

Traders remain cautious, prioritizing inventory turnover over speculation.

Conclusion: Prices are expected to stabilize next week, supported by cost resilience and seasonal restocking.