In January 2026, the seamless pipe market successfully broke its downward streak, entering a channel of moderate growth. The current seamless pipe price index stands at 4,116.79 RMB/ton, up 9.57 RMB/ton month-on-month. This trajectory is not the result of a single driver but a "weak equilibrium" created by three forces: a rigid cost floor, supply-side adjustments, and pockets of demand resilience. However, the fundamental market structure remains fragile, requiring stakeholders to monitor upstream output and downstream restocking closely.

The recent surge in raw materials, particularly iron ore, has directly inflated tube billet costs.

Cost Push: On January 15, the price of 61.5% PB powder at Rizhao Port hit 824 RMB/wet ton, a 5.91% increase within the month. This has pushed the price center for tube billets upward.

Constraints on Gains: Despite rising costs, price transmission is hindered by two factors:

Squeezed Profits: The difficulty of passing costs to end-users is eroding mill margins.

Low Restocking Sentiment: Mill inventories for tube billets fell to 268,700 tons (down 32,200 tons MoM). Under a "purchase-as-needed" strategy, the shortened restocking cycle acts as a ceiling on further billet price spikes.

Verdict: Current price hikes are a passive reaction to high costs rather than a result of active profit expansion or demand-pull.

Supply contraction has created the necessary breathing room for price stability.

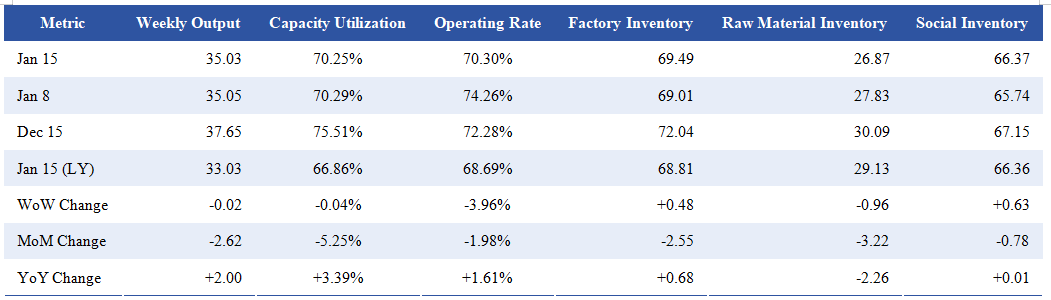

Production Data: As of January 15, weekly output for sample mills was 350,300 tons (down 26,200 tons MoM). While capacity utilization remains higher than last year, there is significant room for further output reduction.

Key Supply Drivers:

North: Severe winter weather has paralyzed outdoor construction (Concrete shipments in Northeast China plummeted 95.32%).

South: Regions like Southwest China saw an 8.38% increase in concrete shipments, marking a "Mini Spring" for local projects.

Environmental Restrictions: Winter in Northern China (Liaocheng, Cangzhou, Tianjin) has triggered heavy pollution alerts, leading to periodic production halts.

"Sales-Driven" Output: A stark divergence has emerged between North and South.

Strategic Cuts: Major mills have planned output reductions of 368,000 tons for the Jan–March period to prevent inventory bloating.

The macroeconomic environment showed signs of life in December 2025:

PMI Expansion: The Manufacturing PMI returned to 50.1%, up 0.9 percentage points.

Key Indicators: The New Orders Index rose to 50.8%, and the PPI decline narrowed to 1.9% (with a 0.2% MoM increase). These indicators suggest that industrial enterprises are beginning a profit repair phase.

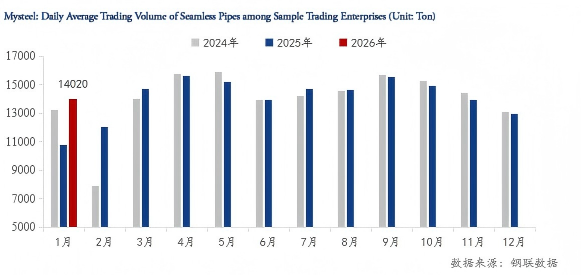

Trading Volume: Daily transaction volumes averaged 14,035 tons in January—a 16.8% YoY increase (adjusting for holiday timing). This growth is primarily concentrated in the more active Southern markets.

The January "mild" rise is characterized by:

Passive Restocking: Stock is moving from factory warehouses to social inventories.

Regional Divergence: Demand is shrinking in the North but resilient in the South.

Macro-Recovery: PMI indicators point toward seasonal restocking before the Spring Festival.

Final Outlook: Whether this upward trend persists depends on the discipline of mills regarding output and the speed at which the mid-to-downstream sectors commit to "Winter Storage."