Overview:Looking back at 2025, the domestic seamless pipe market presented a complex situation of "coexisting pressure and opportunities," driven by intertwined factors such as overseas interest rate hikes, domestic policies (anti-vicious competition/real estate), and supply-demand structures. Overseas rate hikes pushed up the US dollar index, raising the import cost of raw materials like tube billets and squeezing mill profit margins. Domestically, demand contracted, and the recovery rhythm of the real estate chain remained slow. Although policies shifting from "guaranteeing housing delivery" to "supporting reasonable demand"—along with fiscal and monetary efforts—briefly boosted sentiment, the overall performance of national seamless pipes in 2025 was unsatisfactory. Industry profits continued to narrow, mill output increased while demand slipped, and supply-demand contradictions remained prominent.

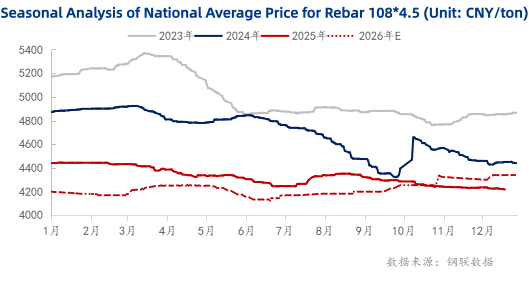

The overall price trend for seamless pipes in 2025 was characterized by downward oscillation with narrowed fluctuation ranges.

H1 (Q1 & Q2): Prices generally experienced a stable decline without significant rebounds, fluctuating between 4,300-4,400 yuan/ton.

Q3 (July-August): July continued the downward channel, hitting the year's second-lowest point at 4,246 yuan/ton. However, August saw a bottom-out rebound across black metals stimulated by favorable macro policies, with seamless pipe prices rising by approximately 110 yuan/ton.

Q4 (September-December): Market sentiment cooled as policy implementation fell short of expectations. Prices shifted downward again, entering a slow decline until the end of December.

Key Data: By the end of 2025, the average price hit a new low for the past 5 years at 4,215 yuan/ton, down 114 yuan/ton from the previous year's low. The annual average price for 2025 was approximately 4,342 yuan/ton, a year-on-year decrease of 348 yuan/ton (down approx. 8.0%).

Looking ahead to 2026, the global rate cut cycle may slow, and geopolitical games and recession expectations persist. Domestically, policy support is expected to increase, helping real estate stabilize. The overall fundamentals are likely to improve in 2026.

General Trend: The domestic steel market is expected to show a "low start, high finish" trend, though the annual average price may shift slightly lower.

First Half Forecast: Seamless pipe prices are expected to fluctuate around an average of 4,200 yuan/ton (±100 yuan/ton). The yearly low point is expected to appear in June.

Second Half Forecast: As fundamentals repair, macro policies land, and delayed demand releases, the market may form a staged rise. The annual high is expected in November, reaching around 4,350 yuan/ton.

Supply Side: Influenced by environmental restrictions and capacity controls, overall incremental output will be limited, maintaining a "tight balance" between supply and demand.

Risk Warning: Market participants should remain alert to risks from sudden changes in the international situation and sharp fluctuations in raw material costs.