As the traditional "Golden March, Silver April" season fades with underwhelming demand, Northwest China’s seamless pipe market faces muted momentum heading into May. Despite modest cost support and tightening supply, prices remain trapped in a narrow range. Here’s a detailed analysis of price trends, profitability, and demand dynamics shaping the region’s post-holiday outlook.

Current Prices (as of April 30):

Xi’an: 4,310 RMB/ton

Lanzhou: 4,410 RMB/ton

Monthly decline: 30–40 RMB/ton

Annual decline: 370–420 RMB/ton

Market Sentiment:

Prices have hovered near year-lows, with minor discounts driving limited transactions.

Downstream buyers remain cautious, prioritizing hand-to-mouth purchases over bulk restocking.

Outlook: Post-holiday price adjustments are likely to stay muted, with traders avoiding aggressive moves amid thin margins.

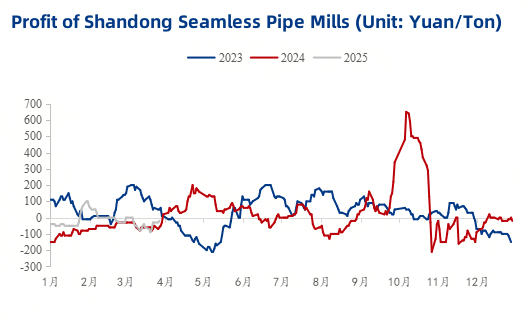

Shandong Mills:

Profits inched up to 10 RMB/ton (+80 RMB/ton weekly), aided by tighter supply and mill maintenance.

Pipe billet costs rose slightly, but inventory pressures eased, supporting mill pricing power.

Supply Constraints:

Reduced output from idled production lines has tightened supply, stabilizing mill margins.

April Sales Volume:

7,924 tons in Northwest China, down 10.75% YoY (vs. 8,878 tons in 2024).

Demand recovery since mid-March failed to offset sluggish restocking and funding constraints.

Downstream Challenges:

Cautious procurement due to rising raw material costs and delayed payments.

No pre-holiday restocking surge observed, reflecting poor confidence in near-term demand.

Supply-Demand Balance:

Mills’ output cuts and inventory controls may prevent steep price drops, but demand lacks catalysts.

Cost Pressures:

Higher pipe billet prices could limit further margin erosion for mills.

Macro Headwinds:

Tight liquidity and weak downstream sectors (e.g., construction, energy) suppress buying activity.

Price Drivers:

Stable Supply: Mill production discipline and low inventories.

Subdued Demand: No imminent recovery in downstream sectors.

Risks:

Prolonged funding issues for buyers.

Global steel trade uncertainties (e.g., anti-dumping measures).

Conclusion: Northwest China’s seamless pipe prices are expected to trade sideways in May, with mills and traders prioritizing inventory turnover over price hikes.