1.1 National Growth Targets & Steel Sector Alignment

China's 5% GDP growth target for 2025 embodies multifaceted equilibrium:

Employment Security: Each 1% GDP growth generates ~2.2 million jobs

Risk Containment: Local government debt-to-GDP ratio capped at 280%

Industrial Upgrade: High-end manufacturing investment share reaches 38% (vs 32.5% in 2024)

1.2 Global Trade Dynamics Reshaping Exports

US Tariff Escalation Impact:

Redirect 18% affected capacity to ASEAN infrastructure projects

Develop weather-resistant steel grades for African markets

Comprehensive 10% tariff activates on March 3, 2025

Critical cost threshold: Export remains viable when domestic price gap <$85/ton

Strategic shifts:

EU Carbon Border Adjustment Mechanism (CBAM):

Mandatory ISO 14064-3 certification from Q2 2025

Carbon cost adders: €126/ton for BF routes vs €36/ton for EAF

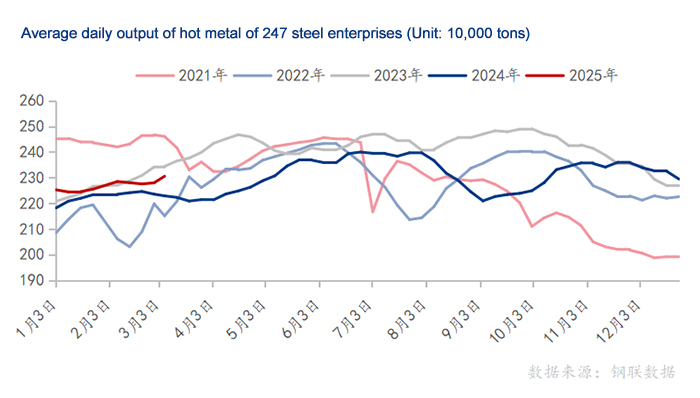

2.1 Iron Output Expansion Analysis

Daily Production Benchmark:

Current: 2.3051 million tons (+2.57% WoW)

Regional capacity distribution:

• Coastal clusters: 37% share with 5,000m³ blast furnace dominance

• Yangtze River belt: 32% capacity featuring hydrogen metallurgy pilots

• Inland regions: 31% output with higher scrap-EAF integration

2.2 Adaptive Production Mechanisms

Profit-Driven Protocols:

Activation thresholds:

• Capacity rotation initiates when margins dip below 200 RMB/ton

• Standby capacity activation requires 30-day sustained 500 RMB/ton margins

Technological enablers:

• Digital twin systems reduce energy use by 7.3% at benchmark mills

• AI-powered scheduling cuts specification changeover time by 42%

3.1 Raw Material Market Transformations

Iron Ore Pricing Paradigm Shift:

Spot prices stabilize at $100.8/dmt (-17.15% YoY)

Strategic adjustments:

• Low-grade ore utilization reaches 28% (2024: 19%)

• Domestic concentrate procurement rises to 25% of total mix

Coking Sector Restructuring:

Capacity phase-out progress:

• 78% of sub-4.3m coke ovens retired

• Dry-quenching adoption hits 91% industry-wide

Price trajectory:

• Current coke at 1,490 RMB/ton (-250 RMB YTD)

• Tenth consecutive price cut activates destocking cycle

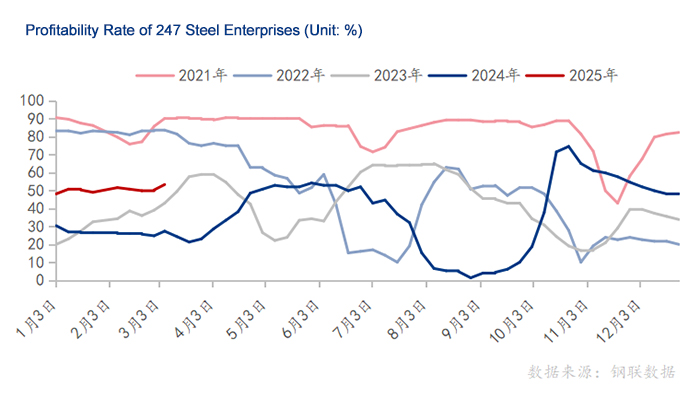

3.2 Profitability Breakthroughs

Sector-Wide Margin Expansion:

Current profitability: 53.25% (+29.01pp YoY)

Regional variance drivers:

• Coastal mills leverage export arbitrage (61-68% margins)

• Inland mills optimize via scrap flexibility (42-49% margins)

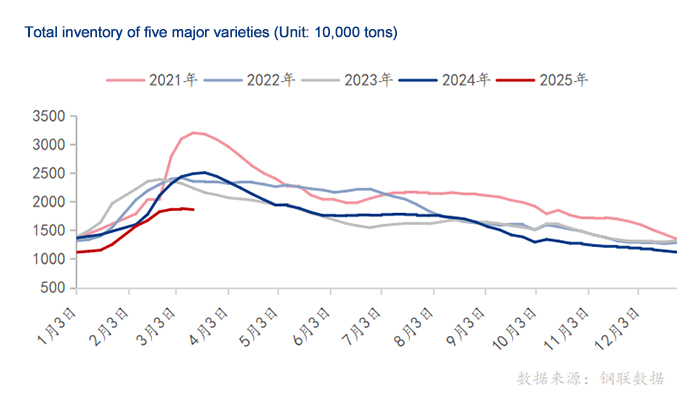

4.1 Stockpile Optimization Trends

Multi-Tier Inventory Framework:

Strategic reserves: 45-60 day coverage for market stabilization

Operational buffers: 20-30 day commercial inventories

Just-in-time stocks: 7-15 day mill-to-project pipelines

Financial Cost Sensitivity:

• 50bps rate hike extends inventory turnover by 5.2 days

• SOE funding efficiency improvements cut carrying costs by 18%

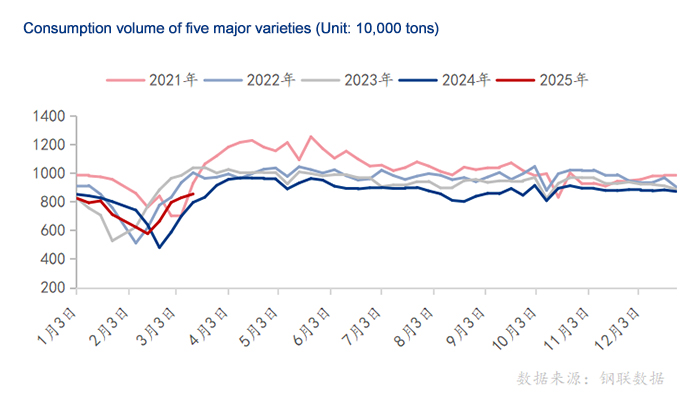

5.1 Infrastructure-Led Demand Growth

Megaproject Steel Intensity:

• Cross-sea tunnels: 680 tons/km specialized corrosion-resistant steel

• Ultra-high voltage grids: 850 tons/km high-silicon electrical steel

• Data centers: 12 tons/rack fireproof structural steel

5.2 Manufacturing Upgrade Imperatives

New Energy Vehicle Innovations:

• Battery enclosures: Aluminum-steel composites with 50W/m·K conductivity

• Integrated castings: 600MPa yield strength thin-gauge steels

• Drive motors: 3.0W/kg ultra-low loss silicon steel

6.1 Price Projection Framework

Multi-Factor Pricing Model:

Price Change = 0.35*(Raw Material Index) + 0.28*(Inventory Coefficient) + 0.22*(Liquidity Conditions) + 0.15*(Policy Expectation)

Scenario Analysis:

• Base Case (60%): 4,200-4,350 RMB/ton range consolidation

• Policy-Driven Rally (30%): Break 4,400 on stimulus measures

• External Shock (10%): Test 4,100 support on trade disruptions

6.2 Enterprise-Level Strategies

Production Optimization:

• Maintain 5-8% flexible capacity buffer

• Implement real-time carbon accounting systems

Supply Chain Resilience:

• Develop iron ore-scrap substitution algorithms

• Pilot blockchain-based material traceability

Market Adaptation:

• Launch index-linked pricing contracts

• Establish cross-regional arbitrage early-warning systems