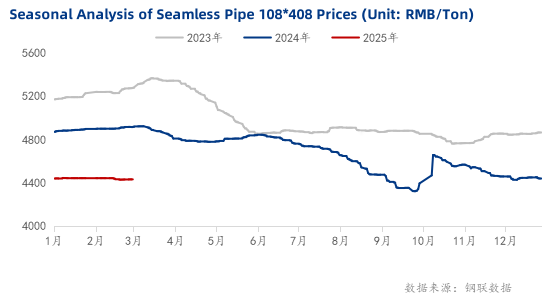

Price Trajectory: National average holds at 4,433 RMB/ton with 0.24% MoM dip in February

Critical Catalysts:

73.03% capacity utilization (+17.12pp YoY)

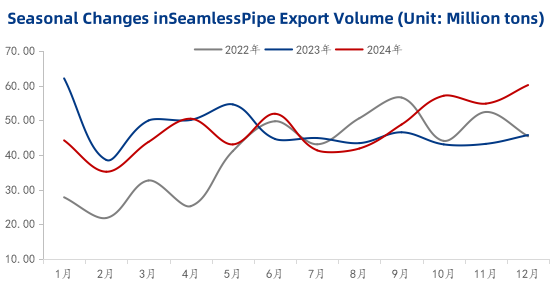

572,260-ton annual export volume (+1.03% YoY)

Fed policy pivot amplifies raw material volatility

March Outlook: 3-5% price rebound projected amid demand recovery and policy tailwinds

National Average: 4,433 RMB/ton (-11 RMB MoM)

Shandong: 4,420 RMB (-0.3% MoM)

Jiangsu: 4,450 RMB (+0.2% MoM)

Post-holiday stability masks 15% demand contraction

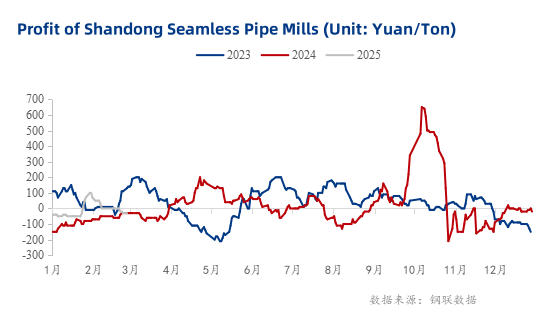

Shandong Mills:

Margins plunge to -30 RMB/ton (-130 RMB MoM)

Legacy high-cost inventory drags profitability

Jiangsu Mills:

Profits climb to 160 RMB/ton (+30 RMB MoM)

Benefit from coastal export arbitrage

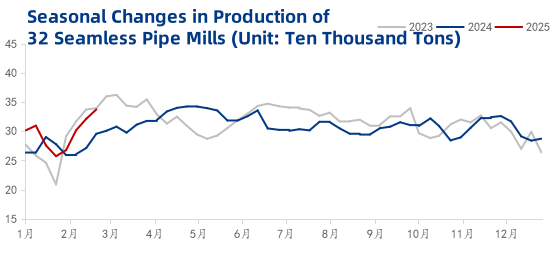

February Output: 337,400 tons weekly (+31% MoM)

Operational Metrics:

Capacity utilization hits 73.03% (17.12pp YoY gain)

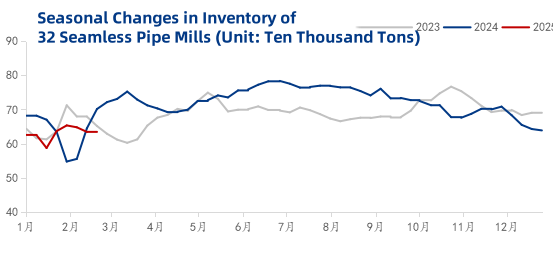

Mill inventories at 634,100 tons (-0.4% MoM)

Strategic Shift: 18% mills adopt AI-driven yield optimization

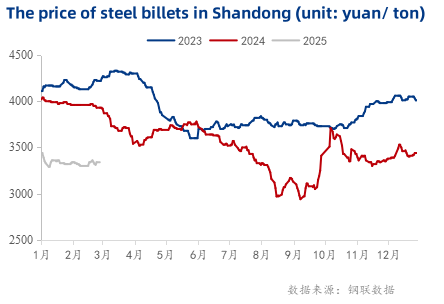

Billet prices dip to 3,536 RMB/ton (-1.03% MoM)

Procurement caution prevails with 29,950-ton mill reserves (-1.9% WoW)

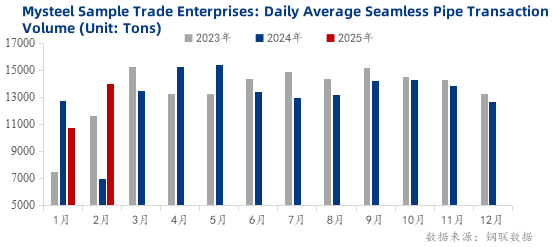

February Transactions: 14,133 tons weekly (-4.4% WoW)

Post-holiday restocking drives 100.12% YoY volume surge

65% traders maintain "wait-and-see" inventories

December Spike: 601,400 tons exported (+31.54% YoY)

Pre-2025 tariff hedge drives order front-loading

Key markets: Middle East (38%), SEA (29%), EU (18%)

Policy Momentum:

15% VAT reduction for infrastructure steels

220B RMB urban renewal package

Two Sessions expected to unveil:

Seasonal Demand:

70% downstream projects to resume by March 15

Northern thaw timeline: March 10-18

Cost Push:

Billet prices projected to rebound 2.5-3.8%

Bull Scenario (40%): 4,480-4,520 RMB range

Base Case (50%): 4,450-4,480 RMB (+0.5-1.0%)

Bear Case (10%): 4,400 support level hold

Inventory Strategy:

Build 45-day coverage of API 5L grades

Rotate 20% stocks via cross-regional arbitrage

Pricing Tactics:

Implement zone-based premium/discount matrix

Hedge 30% exposure via SHFE hot-rolled coil futures

Policy Positioning:

Pre-qualify for Q2 urban renewal tenders

Secure export certifications for EU carbon compliance