The seamless pipe market enters a critical transition phase, with mill inventories dropping 1.19 million tons weekly while social stocks creep upward (+0.12 million tons). Despite a 0.51 million ton production increase, prices slipped 16 RMB/ton nationally to 4,414 RMB/ton as demand recovery lags behind supply growth. Global economic signals remain mixed - UK GDP disappointments contrast with China's 8.2% social financing growth, creating complex pricing dynamics.

Regional Price Movements

Eastern China Dominates Weakness:

Shanghai prices fell to 4,420 RMB/ton (-50 WoW)

Nanjing dipped to 4,260 RMB (-40 WoW)

Hangzhou settled at 4,360 RMB (-60 WoW)

Raw Material Divergence

Shandong billets: 3,620 RMB/ton (+30 WoW)

Jiangsu billets: 4,120 RMB/ton (-10 WoW)

Regional spread narrows to 500 RMB (from 540 RMB)

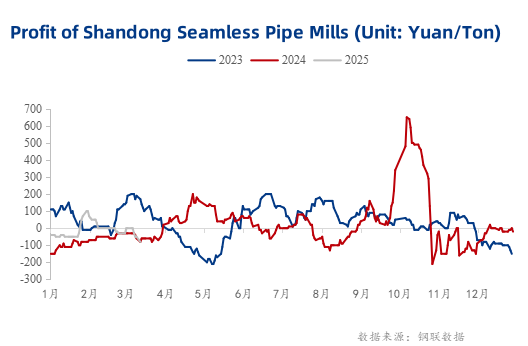

Mill Profit Squeeze

Shandong producers sink deeper into losses: -80 RMB/ton (-80 WoW)

Jiangsu margins hold at 190 RMB/ton through export optimization

Industry-wide profitability index drops to 42 (100=break-even)

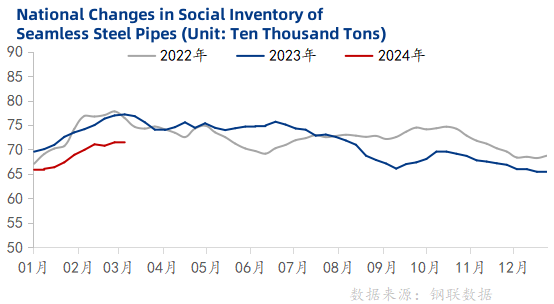

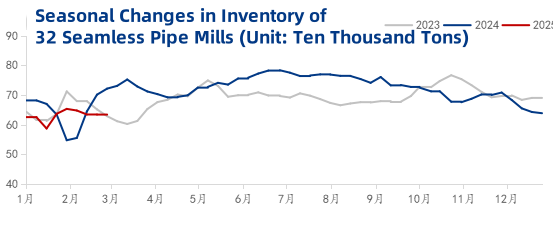

Stockpile Migration

Mill inventories: 618,900 tons (-1.9% WoW, -4.6% MoM)

Social inventories: 717,700 tons (+0.17% WoW)

Critical threshold: Social stocks approaching 725,000 ton capacity ceiling

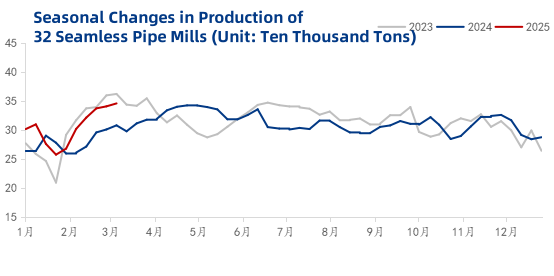

Capacity Expansion

Weekly output hits 346,000 tons (+1.5% WoW)

Operating rates climb to 75.18% (+1.11pp WoW)

8 mills resume production, adding 120,000 ton monthly capacity

Domestic Challenges

Southern rainfall disrupts 23% of construction projects

Trader restocking reluctance: 68% maintain below-average inventories

Policy wildcard: Hohhot's childbirth subsidies signal regional stimulus experiments

Global Headwinds

UK rate cut expectations rise to 56bps for 2025

US PPI at 3.2% fuels inflation vigilance

ASEAN import inquiries drop 12% MoM on tariff concerns

Price Projections

Immediate Outlook: 4,380-4,420 RMB/ton range testing

Downside Risks:

Social inventories exceeding 725K tons

Jiangsu billet prices breaking 4,100 support

Potential Stabilizers:

Infrastructure bond disbursements accelerating

Export rebates for high-grade pipes (draft proposal circulating)

Operational Recommendations

Inventory Strategy:

Mills: Maintain 18-22 day production coverage

Traders: Cap stocks at 25 days with futures hedging

Cost Control:

Lock in Shandong billets below 3,650 RMB via forward contracts

Increase scrap ratio to 28% where feasible

Market Positioning:

Target export markets with EN 10208 certification readiness

Monitor Yangtze River Delta infrastructure tender announcements