Executive Summary

Price Trend: National seamless pipe prices hold steady at 4,433 RMB/ton (108×4.5mm)

Critical Drivers:

73.03% industry capacity utilization (+3.46pp WoW)

1.6 million-ton weekly output (+5% WoW)

Fed rate cut probability surges to 68% post-US inflation data

Market Alert: Social inventory hits 719,460 tons (+0.57% WoW) as downstream demand lags

National Average: 4,433 RMB/ton (+1 RMB WoW)

Shanghai/Nanjing/Hangzhou: 4,450/4,280/4,380 RMB (Unchanged)

Raw Material Costs:

Shandong billet: 3,920 RMB (-20 WoW)

Jiangsu billet: 4,150 RMB (-30 WoW)

Regional price gap narrows to 230 RMB

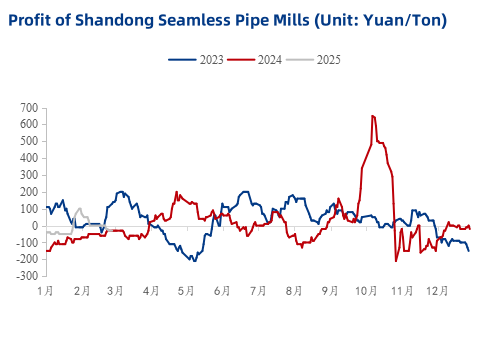

Shandong Mills:

Negative margins deepen to -30 RMB/ton (-30 WoW)

Cost pressures from legacy high-priced inventories

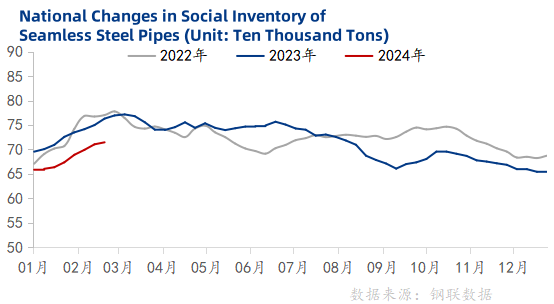

Social Inventory: 719,460 tons (+0.57% WoW)

Eastern China: +1.2% (Pre-season restocking)

Southern China: +0.8% (Delayed project starts)

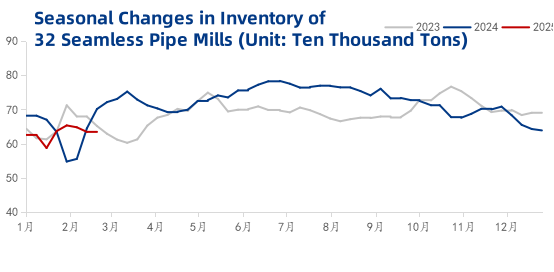

Mill Inventories:

Finished goods: 634,100 tons (-0.05% WoW)

Raw materials: 299,500 tons (-1.9% WoW)

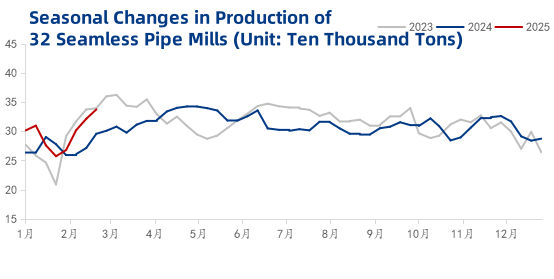

Weekly Output: 337,400 tons (+5% WoW)

Operational Metrics:

Capacity utilization: 73.03% (3.46pp gain)

Operating rate: 51.64% (18.85pp YoY increase)

Strategic Shift: 23% mills adopt JIT production to reduce buffer stocks

Price Stability: 4,380-4,450 RMB range maintained

Inventory Build-up:

Social stocks up 1.8% with cautious March pre-stocking

Specialty grades account for 15% of new arrivals

Trader Sentiment:

65% maintain "hold" strategy pending policy clarity

30% securing futures contracts (CIOPI at 451.2)

Fed rate decision (March 3): 25bps cut priced in

Dollar index strengthens to 104.3 (+0.8% WoW)

Two Sessions Preview:

Expected steel VAT adjustments (17%→15% draft)

Infrastructure bond quota expansion (+18% YoY)

Seasonal Transition:

60% downstream projects to resume by March 10

Northern China thaw timeline: March 12-18

Bull Case (30% probability): 4,450-4,480 RMB range

Requires: Fed dovish signal + accelerated restocking

Base Case (50%): 4,420-4,450 RMB fluctuation

Bear Case (20%): 4,400 support level test

Inventory Management:

Hold 40-50 days of high-turnover specs (219mm below)

Rotate 15% stocks through cross-regional arbitrage

Pricing Tactics:

Implement zone-based pricing (5 RMB/ton/km gradient)

Hedge 25% exposure via SHFE rebar futures

Policy Positioning:

Monitor Two Sessions steel policy roadmap (March 5 release)

Pre-qualify for urban renewal tenders (Q2 rollout)