This week, black metal futures fluctuated, and the cost side showed signs of weakening. On the international front, U.S. President Trump signed a memorandum requiring relevant departments to determine "reciprocal tariffs" for each foreign trade partner. Argentina's inflation rate in January stood at 2.2%, with an annualized inflation rate of 84.5%.

Domestically, on February 14, the People's Bank of China (PBOC) conducted a 7-day reverse repo operation of 98.5 billion yuan, with a bidding rate of 1.50%, remaining unchanged from previous levels. Additionally, the PBOC announced that by the end of Q4 2024, the balance of RMB loans in financial institutions reached 255.68 trillion yuan, marking a 7.6% year-on-year increase.

As of February 14, the average seamless pipe price in major cities showed a slight decline.

According to Mysteel data, as of February 14, the average price of 108*4.5mm seamless pipes across 28 major cities in China was 4,439 yuan/ton, down 5 yuan/ton compared to pre-holiday levels. Most mainstream markets remained stable, while a few saw minor price declines.

Seamless pipe billet prices fluctuated downward this week:

Shandong billet prices dropped 30 yuan/ton.

Jiangsu billet prices fell 40 yuan/ton.

The price gap between Jiangsu and Shandong billets narrowed by 10 yuan/ton.

According to Mysteel’s survey of 34 seamless pipe mills, price adjustments varied, with fluctuations ranging between 20-100 yuan/ton.

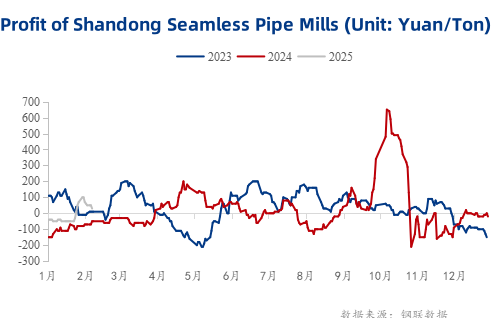

From a profitability perspective, seamless pipe mill profits in Jiangsu declined this week.

Taking 20# hot-rolled, Ф108*4.5mm seamless pipe as an example:

Shandong mills' average profit: 30 yuan/ton, down 70 yuan/ton week-on-week.

Jiangsu mills' average profit: 120 yuan/ton, down 30 yuan/ton week-on-week.

Frequent fluctuations in raw material prices led to unstable profit margins for pipe manufacturers.

Shandong hot-rolled billet prices fell 50 yuan/ton week-on-week.

Seamless pipe ex-factory prices in major Shandong mills saw slight declines.

Shanghai seamless pipe prices remained stable at 4,480 yuan/ton.

Nanjing and Hangzhou prices dropped 30 yuan/ton, now at 4,280 yuan/ton and 4,380 yuan/ton, respectively.

After the Lantern Festival, traders gradually returned to work, leading to a gradual recovery in transactions.

This week, seamless pipe inventories in East China declined slightly, and most traders adopted a rational outlook on future prices. It is expected that East China’s seamless pipe prices will remain stable next week.

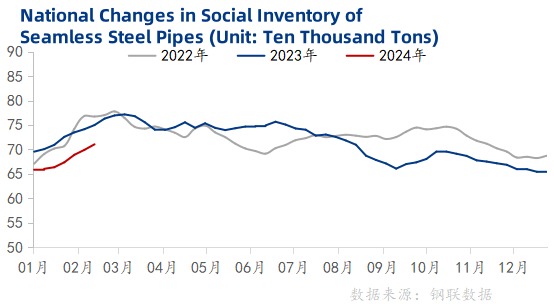

According to Mysteel’s survey on 123 seamless pipe traders:

Total national seamless pipe social inventory: 71.05 million tons, up 1.13 million tons week-on-week.

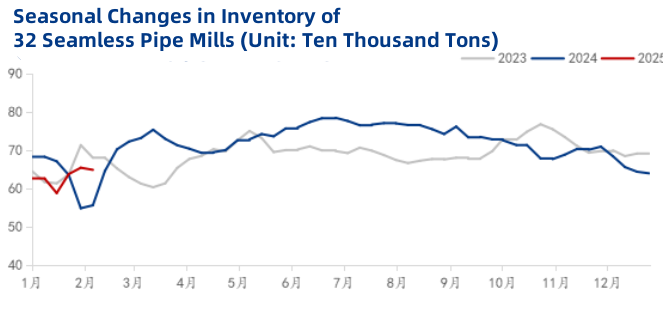

Seamless pipe mill inventory: 64.78 million tons, down 0.55 million tons week-on-week but up 2.28 million tons year-on-year.

Raw material inventory: 30.59 million tons, up 0.33 million tons week-on-week and 2.26 million tons year-on-year.

Following the Lantern Festival, downstream enterprises have gradually resumed production, causing factory inventories to shift towards social inventories.

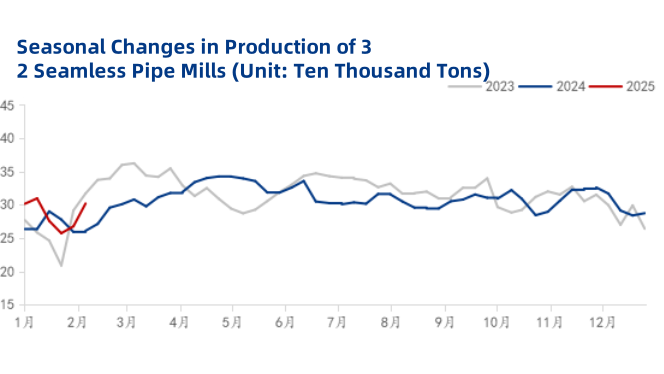

Total weekly seamless pipe production: 30.19 million tons, up 3.42 million tons week-on-week but down 0.78 million tons year-on-year.

Capacity utilization rate: 65.60%, up 7.43% week-on-week but down 1.69% year-on-year.

Operating rate: 49.18%, up 4.10% week-on-week and year-on-year.

With pipe mills gradually resuming operations, production is expected to increase moderately next week. However, the increase in output is not expected to be significant.

Raw material prices declined by 20-30 yuan/ton, reducing cost support.

Downstream demand remains slow, leading to some traders offering hidden discounts to stimulate sales.

Pipe mill inventories are decreasing, while social inventories continue to rise.

Many pipe mills face order pressure, and seamless pipe demand remains weak.

Traders remain cautious, as market trends are uncertain.

Many adopt a wait-and-see approach before making pricing adjustments.

Seamless pipe demand is recovering slowly, while supply is increasing.

Market sentiment remains cautious, with traders closely monitoring price fluctuations.

Next week, seamless pipe prices are expected to experience narrow-range fluctuations.