This week, global and domestic economic dynamics continued to influence China’s steel market. Overseas, the European Central Bank cut interest rates by 25 basis points, while U.S. jobless claims remained stable, delaying expectations for a Fed rate cut. Domestically, China’s Q1 GDP grew by 5.4% year-on-year, but challenges persisted in the property sector, with real estate investment declining by 9.9% in Q1. Against this backdrop, seamless pipe prices dipped slightly, reflecting cautious market sentiment and slower demand recovery.

Price Trends

The national average price for 108*4.5mm seamless pipes fell by 19 RMB/ton this week, settling at 4,339 RMB/ton.

Raw material costs held steady, with pipe billet prices in Shandong and Jiangsu provinces unchanged.

Most manufacturers reduced seamless pipe prices by 20–50 RMB/ton to stimulate sales.

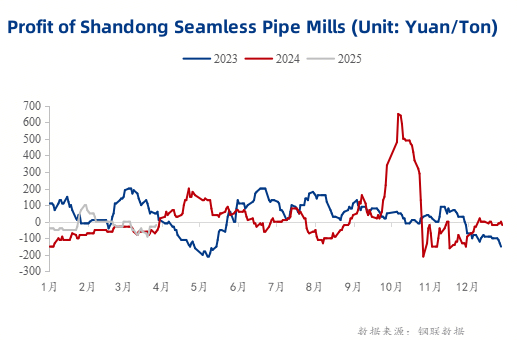

Profitability Pressures

Margins for Shandong-based mills worsened, with losses widening to -80 RMB/ton (down 40 RMB/ton weekly).

Jiangsu mills saw profits shrink to 180 RMB/ton (down 90 RMB/ton) due to price adjustments.

Weak downstream demand and rising inventories are squeezing profitability across regions.

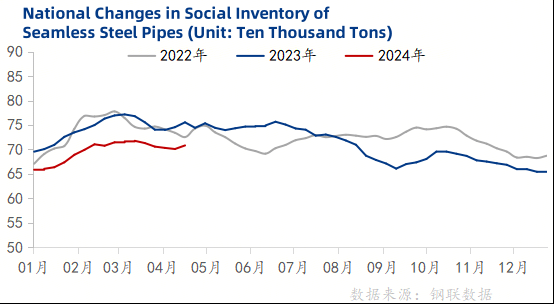

Inventory Dynamics

Social inventories rose slightly to 708,200 tons (+7,300 tons weekly).

Manufacturer inventories increased to 606,600 tons (+4,100 tons weekly), signaling slower order uptake.

Production dipped to 355,900 tons (-12,400 tons weekly), but capacity utilization remains high at 77.34%.

In Shandong and Jiangsu provinces, pipe billet prices fluctuated, leading to cautious price cuts by manufacturers. Despite efforts to clear stock through discounts, weak trading volumes persisted. Social inventories edged lower, but factory stockpiles grew, reflecting tepid demand. With raw material costs stable and competition intensifying, prices in the region are expected to trend downward moderately next week.

Demand: Infrastructure and construction sectors are recovering slower than anticipated, limiting seamless pipe consumption.

Supply: High production levels and rising inventories may pressure prices, but cost support from raw materials could prevent steep declines.

Sentiment: Traders remain cautious, prioritizing inventory turnover over aggressive restocking.

Key Takeaway: While short-term demand remains subdued, market stability is likely in the coming week. Manufacturers and traders will focus on balancing margins with competitive pricing strategies.